FAQ: Frequently Asked Questions

- What is the CNAE?

-

The CNAE is a statistical classification of economic activities.

It is used to summarise and present information about the economic activity of companies in economic statistical operations and other domains (social, environmental, etc.).

For this purpose, the CNAE consists of a hierarchical structure that is divided into four levels:

- Section: The most general level, represented by a letter.

- Division: A more specific level, identified by two digits.

- Group: Adds a third digit for greater precision.

- Class: The most detailed level, with four digits.

Various activities of similar nature, that is, activities that share a common productive process, are grouped together under the same category in the NACE.

The CNAE is an exhaustive classification, meaning all economic activities are included in it, either explicitly or implicitly. It is also exclusive, meaning each economic activity must appear in only one category (at each hierarchical level).

The classification is designed so that the content of each class encompasses a set of economic activities that are statistically significant in the national economy. Otherwise, there could be issues with confidentiality and breaches of statistical secrecy when disseminating the data.The CNAE is related to other international classifications:

- NACE (European Classification of Economic Activities): it is developed by the European Statistical System and has four levels. The NACE is aligned with it up to the third level, and it is compatible with the NACE in the fourth level (the classes of the CNAE are subcategories of those in the NACE).

- ISIC or CIIU (International Standard Industrial Classification of all Economic Activities): it is maintained by the UN¿s Statistics Division. The NACE is developed to coincide with the CIIU up to the second level. From the third level onward, NACE categories are subcategories of the CIIU.

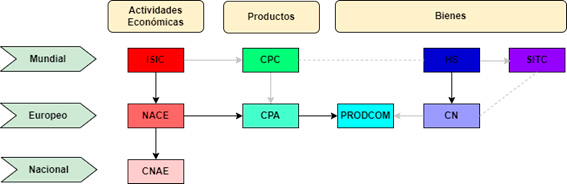

Both NACE and CIIU are related to various statistical classifications of products and goods, as shown in the following diagram:

With this harmonisation between different classifications, international comparability of statistical data is achieved, as well as the possibility to generate new knowledge by crossing data from various domains: economic, social, environmental, etc.

It is common for the same company to carry out more than one economic activity. In order to summarise the information in the statistics, only one of them is selected, the so-called "main activity", which is, in general terms, the one that provides the greatest added value. For its selection, the top-down method is followed, as explained in the Introductory Notes of the CNAE-2025.

-

- Why and how is the CNAE reviewed?

-

Statistical classifications are reviewed periodically to reflect the economic and social changes that, in the case of the CNAE/NACE/CIIU, lead to the emergence of new economic activities and the diminishing relevance of others. This process ensures that classifications remain useful and accurate tools for the statistical analysis of the economic reality.

In 2019, the review of the CIIU (ISIC) began, which in turn initiated the review of the NACE and, consequently, the CNAE.

In this context, a working group was established, comprised of producers and users of official statistics. Periodic presentations were made to the collegiate bodies of the National Statistical System (High Council on Statistics, Interministerial Statistics Commission, Interterritorial Statistics Committee), with representation from multiple sectors of society. Additionally, between September and November 2022, an initial consultation was conducted to gather proposals and comments on a preliminary version of CNAE-2025. Between March and April 2023, a second open consultation was launched via the INE website, allowing all citizens to submit comments, suggestions, and proposals regarding a second preliminary version of the classification.

As a result of all these processes, new versions of the following classifications were developed: ISIC Rev.5, NACE Rev.2.1, and CNAE-2025..

-

- Uses of the CNAE

-

The CNAE is primarily used by producers of official statistics (National Statistics Institute, Ministerial Statistical Units, Central Statistical Bodies of the Autonomous Communities, etc.) for the compilation of economic statistics. Various organisations and institutions use the CNAE for non-statistical purposes (administrative purposes regarding taxes, social contributions, subsidies, etc.). In these non-statistical areas, the INE has no responsibility over the use of the CNAE, nor over the regulations and administrative implications. The INE also has no knowledge of the CNAE codes assigned to companies outside the field of statistics. However, for some time now, efforts have been made to coordinate various public bodies to match statistical information. Additionally, the INE, as the general coordinator of the statistical services of the State Administration, offers its assistance and support for the classification of economic activities according to the CNAE, following international statistical standards.

-

- What is my CNAE-2025 code?

-

Following the revision of the CNAE-2009, the new CNAE-2025 classification has been developed, which reflects the economic and social changes of the last few years. To make it easier for users of the classification to find the code that corresponds to a particular economic activity in the CNAE-2025, the INE has developed a tool called CodIA, based on Machine Learning technology.

CodIA allows, based on a description of the economic activity and, if known, the CNAE-2009 code, to obtain a list of possible codes for said activity, from which the user may select the one he or she considers most appropriate.

The explanatory notes of the CNAE-2025, as well as the correspondence tables between the CNAE-2009 and the CNAE-2025 and other classifications are also available for consultation and coding assistance. This material can be found at the following location.

-

- How do I know which CNAE code is assigned to my company? How do I obtain a certificate?

-

Nowadays, it is common for a company to carry out several economic activities. For the production of official statistics, the methodology establishes that a single code must be selected identifying the main activity. This procedure is established in a harmonised manner in the European Statistical System through the top-down method, guaranteeing the coherence and comparability of economic statistics. The assignment is carried out and reviewed by experts from the INE and the ministerial statistical units. Being a statistical variable, the INE does not issue certificates of the activity codes of any of the statistical units it analyses for statistical production.

In the non-statistical field, the INE has no responsibility for the use of the CNAE, nor for the regulations and administrative implications. The INE also has no knowledge of the CNAE codes assigned to companies outside the statistical field. However, for some time now there have been efforts to coordinate between various public bodies to harmonise statistical information.

If you need the CNAE code corresponding to one or more of the economic activities, you can use the coding assistance tool CodIA or consult the available technical documentation: structure, explanatory notes, correspondence tables, etc. in the following location.

-

- How do I request the creation of a specific code for my company or business association?

-

The CNAE is a classification developed by the National Statistical System for statistical purposes only. It is also closely linked to a family of international classifications.

Various organisations and institutions use the CNAE for non-statistical purposes (tax administration, social security contributions, subsidies, etc.). In these non-statistical areas, the INE has no responsibility for the use of the CNAE, nor for the regulations and administrative implications. The INE also has no knowledge of the CNAE codes assigned to companies outside the statistical field. However, for some time now, efforts have been made to coordinate various public bodies to harmonise statistical information.

Due to the very nature of a statistical classification, whose objective is to group and summarize information, the headings usually encompass more than one economic activity. These must be similar in terms of classification, that is, they must share a common process of production of goods or services.

Within the same company or federation of companies, it is common for more than one economic activity to be carried out. These economic activities may be grouped under the same CNAE class or classified under various headings throughout the CNAE structure, often even in different hierarchical branches. Due to the nature of statistical classification, in which the categories must be exclusive, it is not possible to create headings for combined activities that are already included, separately, in different categories of the classification.

-

- What CNAE code should I provide to other organizations?

-

In the statistical field, the Royal Decree establishing CNAE-2025 establishes complete coordination with the application calendar of the European classification NACE Rev.2.1 set by Regulation (EU) 2023/137 amending Regulation (EC) No 1893/2006 and establishing the statistical nomenclature of economic activities in the European Statistical System.

In the non-statistical field, the INE is not responsible for the use of the CNAE, nor for the regulations and administrative implications. Therefore, it will be these organisations that will provide the corresponding regulations.

Nevertheless, the INE offers assistance in coding economic activities, both according to CNAE-2009 and CNAE-2025, through the CodIA tool.

Technical documentation can also be consulted..

-

- Main changes between CNAE-2009 and CNAE-2025

-

Below is a summary of the main changes in NACE and CNAE regarding the number of categories:

Epígrafe CNAE-2009 CNAE-2025 NACE Rev.2 NACE Rev.2.1 Sections 21 22 21 22 Divisions 88 87 88 87 Groups 272 287 272 287 Classes 629 664 648 651 Main changes:

- Intermediation activities: due to the increase in this type of activity as a result of technological advances and digital platforms, numerous new classes have been created for these activities, which were previously grouped either within the classes of products or services being intermediated or under class 82.99 Other business support activities n.e.c.

- Manufacturing industry:

- New classes have been created for product finishing activities that are typically carried out by third parties.

- The manufacturing of specific parts and the manufacturing of an entire product are now classified under the same class.

- New classes have been created for the manufacturing and repair of military vehicles, ships, and aircraft.

- Trade:

- Division 45 Sale and repair of motor vehicles and motorcycles has been removed, and its activities are now included under division 46 Wholesale trade, 47 Retail trade, and 95 Repair and maintenance of computers, personal and household goods, and motor vehicles and motorcycles.

- Due to the rise of online commerce, classification criteria based on retail sales channels (physical, online, markets, etc.) have been eliminated.

- The production classes within group 35 Electricity, gas, steam, and air conditioning supply have been restructured, emphasising whether the energy source is renewable or not.

- Division 38 Waste collection, treatment, and disposal activities has been restructured. Greater emphasis has been placed on how waste is reused.

- The classes for land passenger transport within division 49 Land transport and pipeline transport have been restructured.

- Section J Information and communications has been divided into two new sections:

- J Publishing, broadcasting, and content production and distribution activities..

- K Telecommunications, computer programming, consultancy, IT infrastructure, and other information services..

-

- Implementation of the CNAE-2025

-

In the statistical field, the Delegated Regulation (EU) 2023/137 of the Commission was approved on 10 October 2022, which establishes the use of NACE Rev.2.1 in European statistics. This delegated regulation also defined the timeline for the various members of the European Statistical System to transmit data using the new nomenclature.

In line with this, the INE will gradually incorporate the use of CNAE-2025, starting from 1 January 2025, in the various statistical operations for which it is responsible, in order to comply with European legislation.

-

- Technical documentation

-

Below is the list of technical documentation related to CNAE-2025 and where it can be accessed:

- CNAE-2025 Structure

- CNAE-2025 Explanatory notes

- CNAE-2025 Explanatory document

- CNAE-2025 Introductory notes

- Correspondence tables between CNAE-2009 and CNAE-2025

- Correspondence tables between CNAE-2025 and CNAE-2009

- Correspondence tables between CNAE-2025 and NACE Rev.2.1

- Correspondence tables between NACE Rev.2.1 and CNAE-2025

- Royal Decree approving NACE-2025

If, after reviewing the available material, you need clarification on any aspect of NACE, you can contact the INE coding experts via email at nomenclaturas@ine.es.

-

Other classifications out of date

CNAE-93 Rev.1

- Complete structure (In Spanish)

- Explanatory notes (In Spanish)

- Descripción (In Spanish)

- Correspondences between CNAE-93 Rev.1 with: CNAE-93 and NACE REV.1.1 (In Spanish)